Allowable depreciation calculator

For depreciation purposes or when you sell the asset the basis of your. Three factors help determine the amount of Depreciation you must deduct each year.

Depreciation And Book Value Calculations Youtube

Section 179 deduction dollar limits.

. This limit is reduced by the amount by which the cost of. Year Tax-allowable depreciation. Calculating Depreciation Using the Units of Production Method.

The adjust cost basis is original cost basis less. First one can choose the straight line method of. This depreciation calculator is for calculating the depreciation schedule of an asset.

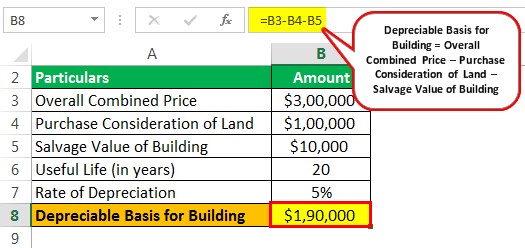

How to Calculate Depreciation in real estate. The IRS also allows calculation of depreciation through table factors listed in Publication 946 linked below. 23125 4 40000 5000- 23125.

The tool includes updates to. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Asset cost - salvage valueestimated units over assets life x actual units made.

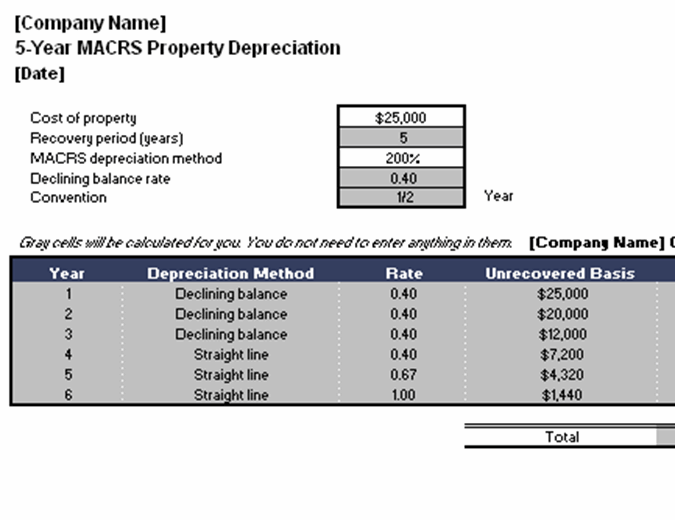

Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate the rate and expense amount for personal or real property for a. A balancing allowance is claimed in the final year of operation. Also includes a specialized real estate property calculator.

It is determined based on the depreciation system GDS or ADS used. Cost of Asset Useful Life Yearly. For depreciation purposes or when you sell the asset the basis of your depreciable property must be reduced by the depreciation.

This provides you with the yearly allowable depreciation. Class 1 building acquired. Capital Cost Allowance Permitted Depreciation Undepreciated Capital Cost Depreciation Rate Canada Revenue Agency Classification Class 1.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. The recovery period of property is the number of years over which you recover its cost or other basis.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Note that this figure is essentially equivalent. Depreciation Calculator Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation.

It provides a couple different methods of depreciation. Ie Asset put to use on or before. Determine the adjusted cost basis.

The companys cost of capital is 8. When you need to calculate your propertys basis eg. Using TaxAct Depreciation - Allowed or Allowable When you need to calculate your propertys basis eg.

Depreciation not refigured for the AMT. The allowable depreciation expense incurred is 20 of 10000 for 4 years ie 8000. This calculator calculates depreciation by a formula.

Except for qualified property eligible for the special depreciation allowance. Before you use this tool. To calculate the allowable depreciation you must divide the cost of the asset by the useful life.

If asset is put to use for less than 180 days then amount equal to 50 of the amount calculated using normal depreciating rates is allowed as depreciation. Dont refigure depreciation for the AMT for the. Your basis in your property the recovery.

Depreciation Of Building Definition Examples How To Calculate

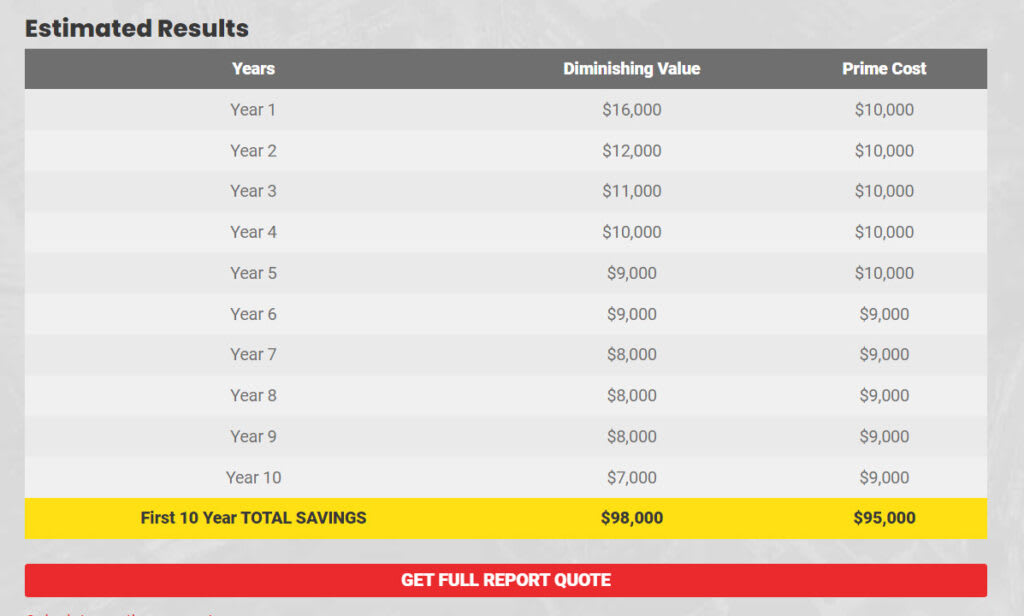

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Doctors Notes For School Check More At Https Nationalgriefawarenessday Com 40085 Doctors Notes For School

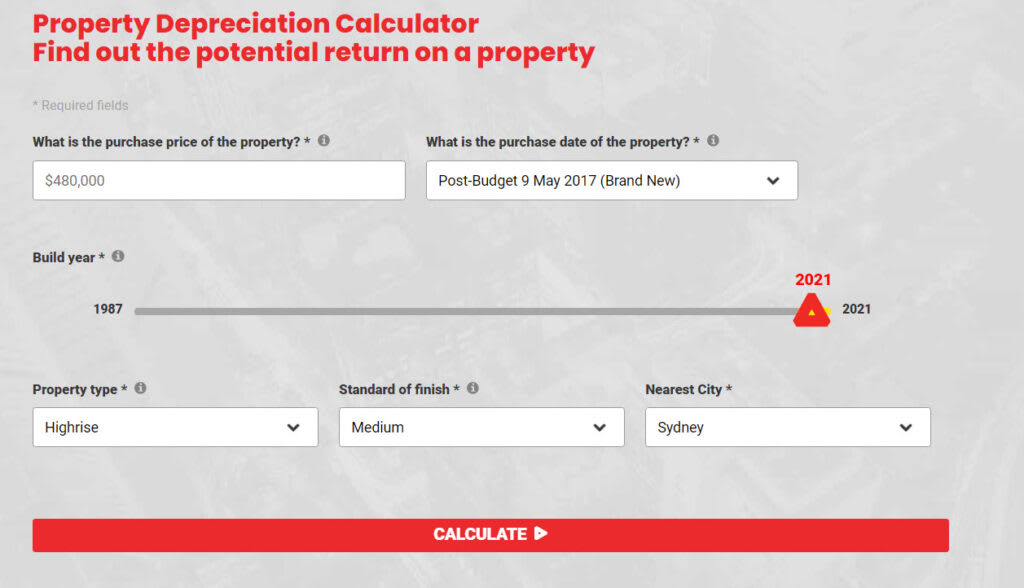

How To Calculate Depreciation On Investment Property Wb

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Depreciation Worksheet And Leap Years Manager Forum

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Calendar For 4 4 5 Accounting Period Ifs Community

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Capital Investment Appraisal Tax Allowable Depreciation Acca F9 Youtube

How To Calculate Depreciation On Investment Property Wb

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl